- Empty cart.

- Continue Shopping

Royalties & Payments

Contents:

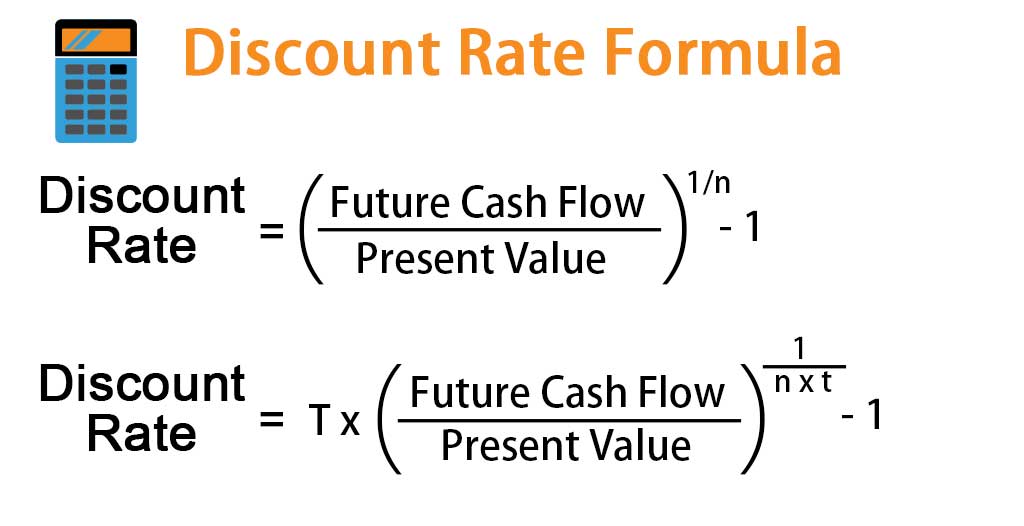

In such a case whatever yield is taken out by the lessee and sub-lessee is added and on this total yield lessee has to pay royalty to the landlord. Recoupment of short working refers to recovering the short working of any year, from surplus royalty of the succeeding years. The Recoupment may be permitted over a stipulated period of time or over a specified period following the year of short working or within the life time of the lease. The NPV of a future income is always lower than its current value because an income in the future is attended by risk.

- Most countries have “practices” more in common with the UK than the US.

- Regulatory provisions in the US, EU and elsewhere is in a state of flux, continuously being challenged by developments in technology; thus almost any regulation stated here exists in a tentative format.

- If the writer’s work is only part of a publication, then the royalty paid is pro-rata, a facet which is more often met in a book of lyrics or in a book of hymns and sometimes in an anthology.

- To access and use ideas which other people have generated for the purpose of promoting their business, a firm may pay royalties.

- The satellite TV services such as Direct TV and cable television services pay networks and superstations a royalty fee to broadcast those channels on their systems.

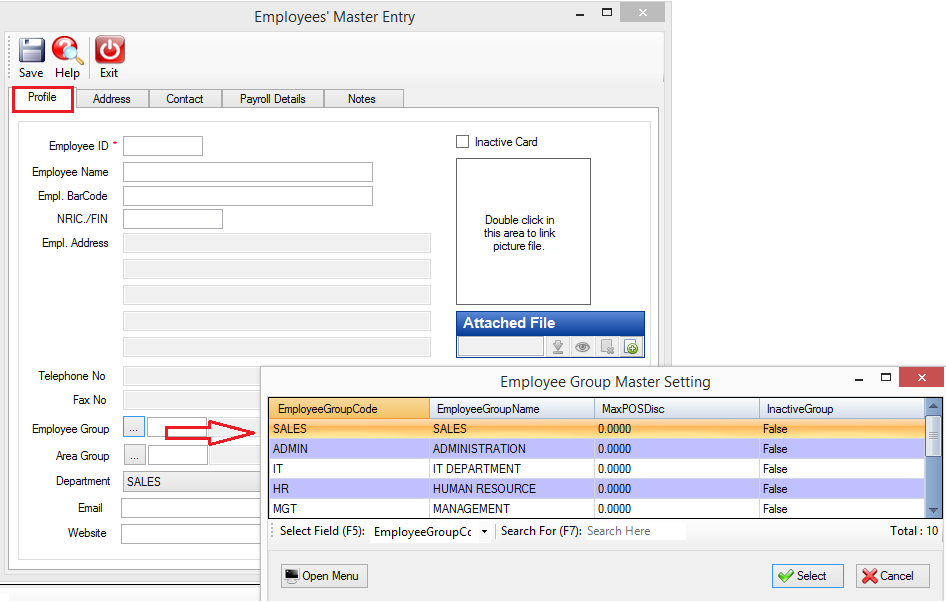

- Processing Revenue Data We learned about the big amount of data that is processed by publishers, so a tool that can process this data is key to any publisher.

Each such statement shall be certified by an officer of the LICENSEE as being true, correct and complete. Concurrent with the submission of each such report, LICENSEE shall pay TUFTS any royalties due for the calendar quarter covered by such report. Trade mark rights and royalties are often tied up in a variety of other arrangements. Trade marks are often applied to an entire brand of products and not just a single one. When the rights of trade mark are licensed along with a know-how, supplies, pooled advertising, etc., the result is often a franchise relationship.

Royalty Accounting

Another example would be a computer manufacturing company obtaining the rights to use an operating system, such as Windows. If this was the case, they would pay Microsoft Corporation a royalty percentage to use the operating system in the computers that they manufacture. Royalty payments are tax reportable and are reported according to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.

BMG bigs up rights and royalty management capabilities in stats … – Complete Music Update

BMG bigs up rights and royalty management capabilities in stats ….

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

An individual can pay to open a restaurant franchise, McDonald’s or Kentucky Fried Chicken, for example. A franchisee of the McDonald’s Corporation has a typical initial investment of one to two million dollars, which includes an initial franchise fee of up to $45,000 paid to the McDonalds corporation. Draft a license agreement that spells out the particulars as stated in this article. Visit your attorney and request or demand an accounting as the case may be. If you are entitled to the royalties you are entitled to an accounting. The rent, paid to the landlord for the use of land or surface on the yearly or half yearly basis is known as Ground Rent or Surface Rent.

How Many People Does it take to Screw in a Trademark Licensing Agreement

For example, if the carrying amount of a royalty asset exceeds its recoverable amount by $100, then impairment is posted in the books of the intellectual rights owner . Let us assume the subsequent royalty payment is 6% of net income of $10,000 paid quarterly. At the end of the quarter, royalties due are calculated by multiplying net income of $10,000 by 6%, which is $600 . After the prepayment is exhausted, the licensee’s cash balance is credited . The person, or third party, that enters into the licensing agreement would pay royalties back to the creator, or licensor. When it comes to a licensor, the royalty agreement would allow other companies or third parties to use their product or service, ultimately providing them access to a new market.

29€ $ DIY label Everything you need to create statements for as many artists as you want, with the ability to process sales from up to 5 royalty sources. Doing royalty accounting was always a nightmare, we were dreading each time it had to be done but eddy.app has really made a difference for us. Eddy.app allows you to easily report music royalty revenues from all of your royalty sources, for all your artists, all at once.

IRS extends transition period on foreign withholding taxes – Accounting Today

IRS extends transition period on foreign withholding taxes.

Posted: Mon, 03 Apr 2023 07:00:00 GMT [source]

Where Royalties are less than minimum rent and shortworkings are recoverable in next years. Shortworking will be shown on the asset side of Balance sheet up to allowable year of recouping after that it will be transferred to profit & loss account . An Author or publisher; lessee or patentor who takes out rights from the owner on lease against the consideration is called tenet.. Patent Royalty − Patent royalty is paid by the lessee to lessor on the basis of output or production of the respective goods. Distributor Statements/Portal Login – We will interface, reconcile, and ingest your sales data.

THE OWNER S ROLE IN PROJECT RISK MANAGEMENT Quantitative risk assessment Risk

Martin Luther wanted his entire congregation to take part in the https://1investing.in/ of his services, not just the choir. This new chorale style finds its way in both present church music and jazz. Until the mid-18th century, American popular music largely consisted of songs from the British Isles, whose lyric and score were sometimes available in engraved prints. Mass production of music was not possible until movable type was introduced. At the beginning the type consisted of the notehead, stem and staff which were combined into a single font. Later the fonts were made up of the notehead, stems and flags attached to the staff line.

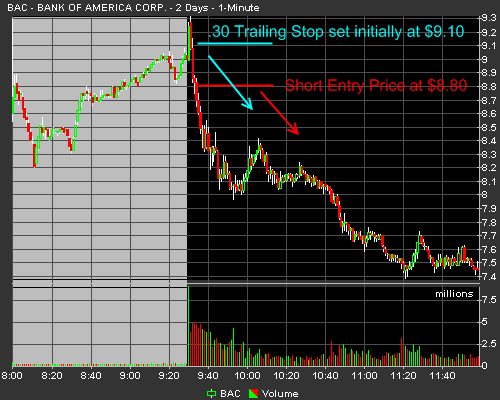

Producer Royalties– Some producers are paid based on percentage of revenue the label earns from a song. Download a free copy of MetaComet’s Royalty Automation Handbook and see how you can reduce your effort by up to 90%, simplify your processes and maximize accuracy in your royalty accounting. Excluding all non-royalty expenses, the transaction in our example has grossed £90,000 in profit. We can also now easily see what our reserve balance is, and the level of pre-paid royalties—which is negative here because we did not include the creation of the initial advance. We typically ask licensees to pay and report 30 days after each quarter ends. We have a royalty report template we use, although some licensors may use an online royalty reporting system likeRoyalty Zone,Brand ComplyorDependable Solutions.

Amount of royalty charge to profit and loss account will be Rs. 1,000,000/- and balance amount of Rs. 100,000/- will be deposited in the credit of central Government account. Royalty Solutions Corporation understands these challenges and offers a variety of label services to prioritize your royalty processing. RSC is the answer to processing royalties rather than having an in-house royalty department. Our staff is fully trained and dedicated to royalties and will ensure that everything is accounted for properly. Eddy.app turned out to be an ergonomic solution for processing our sales and creating royalty statements. Thanks to regular and thorough customer care, we have been able to adapt the platform to our needs.

- Not all music providers in the UK were part of the compromise that led to the legislation.

- In the conventional context, royalties are paid to composers and publishers and record labels for public performances of their music on vehicles such as the jukebox, stage, radio or TV.

- No person or entity, other than the copyright owner, can use or employ the music for gain without obtaining a license from the composer/songwriter.

- An estimated 60% of royalties are incorrectly paid out to rights holders.

You should understand what royalties are if you create intellectual property or are working for a business that does in order to be able to make informed judgments. A completed and signed IRS Form W-9 should be attached to the payment request form and supporting documentation (PIR, DP, P.O., etc.). An invoice or other supporting documentation should be provided with the payment request form (PIR, DP, P.O., etc.). Use a UW payment request form and supporting documentation (PIR, DP, P.O., etc.). The latter is more than mere access to secret technical or a trade right to accomplish an objective.

Things get more complicated if royalty calculation prescribed by the contract relies on forecasts of future sales volumes to assess the correct stepped royalty rate to apply. Most of the time, royalties are an excellent type of revenue generator. They’re designed to help compensate the original owner of an asset when another party uses them.

Music royalties come from copyright or intellectual property and the owner is paid before stockholders, company executives, etc. Greenlight Financial can help artists calculate how much royalties are due to them. We can also help small record labels when calculating the royalties due to their songwriters. The next diagram shows the sequences in the licensing of performances and the royalty collection and distribution process in the UK. Every song or recording has a unique identity by which they are licensed and tracked.

An inventor or original owner may choose to sell their product to a third party in exchange for royalties from the future revenues the product may generate. For example, computer manufacturers pay Microsoft Corporation royalties for the right to use its Windows operating system in the computers they manufacture. Sometime, there may be stoppage of work due to conditions beyond control like strike, flood, etc. in this case, minimum rent is required to be revised as provided in the agreement.

According to Upcounsel, a nationwide legal services company, the industries with the highest average royalty rates are software (9.6%), energy and environment (8%), and health care equipment and products (6.4%). The industries with the lowest average royalty rates are automotive (3.3%), aerospace (4%), and chemicals (4.3%). Statement Delivery and payment processing – We provide you with accurate, timely, and professionally prepared royalty statements on a semi-annual, quarterly, or monthly basis depending on your reporting needs. Royalty Solutions can also handle the statement and payment distributions on your behalf if you so choose. The royalty management module processes sales and usage data, calculates and validates royalties in and out, allows for deductions/recoupments, handles violations, enables analytics, and generates royalty statements.

Although each contract is different, a 20%-30% reserve held for three to four periods is not uncommon. Some publishers automatically withhold a reserve on every new book, while others make a title-by-title decision based on the type of book . Since the reserve is still a liability, albeit a deferred one, it should not be netted from the total Royalties Payable liability account. The monthly entry consists of a debit to royalty expense, which is part of the cost of goods sold, and a credit to the royalties payable liability. This entry can be either an estimate calculated as a percentage of sales based on historical data or an actual figure provided by the publisher’s automated royalty system. Our royalty accounting services stretch from accurate bookkeeping, to royalty tracking, payment automation, and financial reporting.

If you utilize an outdated or manual accounting system, you will fail to maximize the potential of your business and build trust with your clients. Print Music Royalties– If you are a classical or film composer, once your composition is transcribed to sheet music, you are due print music royalties from the print music publisher for each copy of the composition. Credit Prepaid Royalty—where you would have originally recorded the advance—by £1,000. Field of use is a restriction placed on a license granted for the use of an existing patent, invention, or other intellectual property. The satellite TV services such as Direct TV and cable television services pay networks and superstations a royalty fee to broadcast those channels on their systems.

Major how to write a receipts have the resources to build their own custom tools to manage their royalty processes. Tech companies have also jumped in and built tools that can be licenced by independent publishers. When reviewing which platform works for you, it makes sense to consider the functionalities that are key to a good royalty accounting platform. Storing Contract Data A complete royalty platform will have built tools for publishers to store their contract details. Any data points such as the different royalty rates, reporting frequency, reporting currency and length of the contract can be stored.

With eddy.app, you’ll be managing margins, profits, and losses all from one place. Benchmark artists and releases while evaluating your label’s ROI with our comprehensive music royalty accounting software. Note that the buyer of intellectual rights would simply stop selling non popular items, and as result no royalty payment will be needed and no accounting entries are expected to be posted in the books of the licensee .